LIEN SEARCH EXPLAINED

What is a municipal lien search?

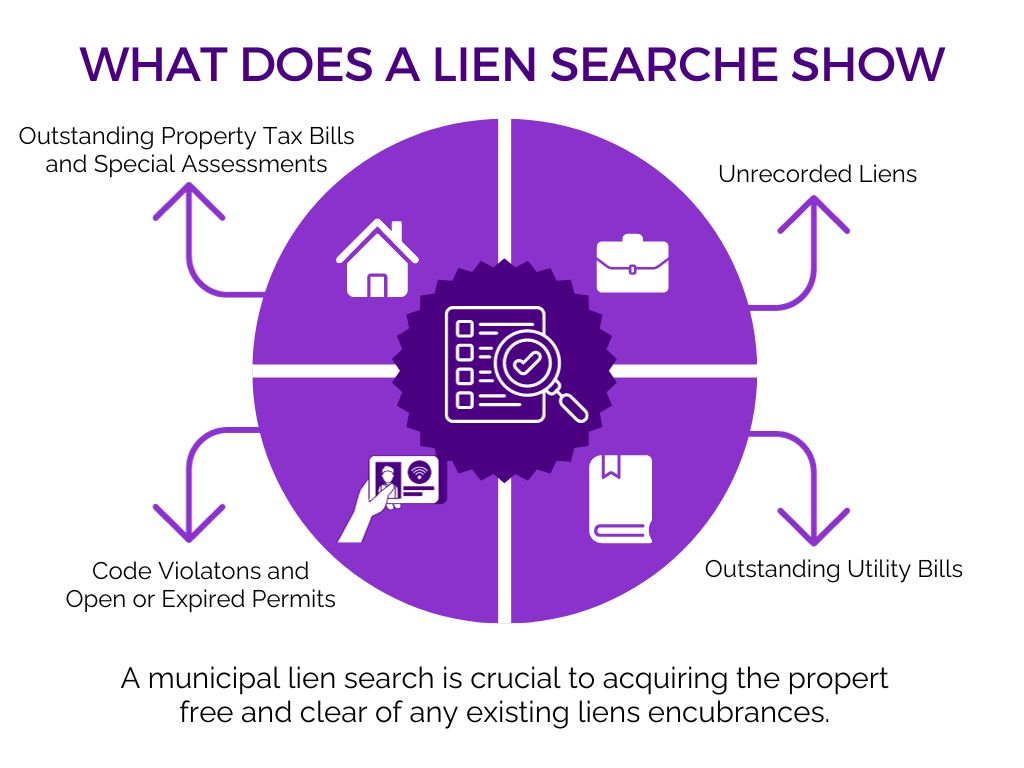

A municipal lien search allows you to find unrecorded liens, code violations, special assessments, utilities, and open or expired permits issues that are associated with residential or commercial real estate.

This is a vital piece of information, as there are often unknown or undisclosed fees, costs or other issues that impact a buyer post-closing.

In Florida these “hidden issues” are attached to the property and not to the owner. So, if this issues are not solved before closing, the buyer would be responsible for curing such issues, which could be very time-consuming and costly.

Is the municipal lien search covered by a title search?

NO! Not only do title underwriters not perform municipal lien searches, but they specifically exclude these matters from title coverage.

This is the client’s responsibility but relax… PRONTO is here to assist doing the research.

Types of liens: Voluntary & Involuntary

There are many reasons a lien may be placed on a property. There are voluntary liens, like a mortgage, to involuntary liens, like money owed to a specific jurisdiction, organization or related party. Here’s a list of the types of debt or fees that can be issued as a Florida municipal lien:

- Real estate property taxes

- Back taxes to the IRS

- Mechanic’s lien (e.g., construction work)

- Code enforcement violations

- Open & expired permits

- Special assessments

- Municipal (e.g., water, sewer, solid waste, and other charges)

- County debts

- Building violations

Some of these will be listed as unrecorded liens, which is why this research is critical. Unrecorded liens can be from a simple permit left open by a contractor or more complicated, such as ones involving code enforcement violations and unpaid fines.

Is a municipal lien search required by Florida law?

Florida state law does not require a municipal lien search.

BUT, but some counties like Miami-Dade and Broward, the standard real estate contract requires the seller to provide a municipal lien search for the buyer, while other counties do not require such a search. Still, most transactions include it as a precaution.

Note that failure to discover these issues before closing means that the buyer would be responsible for outstanding bills or bringing a property into compliance with municipal regulations.

The Florida municipal liens ruling

Florida has long had a “first in time, first in right” policy. This is a way of prioritizing liens based on filing order so that debts recorded earlier are superior to those that follow when courts consider the order for repaying creditors or lenders.

This has worked for Florida lenders, who know all other claims come second. They’re able to make strategic business decisions knowing existing county liens or other tax liens.